Level Up Your Finances with Online Money Management Courses

Has it ever happened to you to forget how much money you spent a month ago?

Effective money management and personal finances are quite important as we need money to pay for rent, buy food and groceries, and more to fulfill our basic needs. Sadly, many of us lack the fundamental skills necessary to handle our own finances. In today’s rapidly evolving world, efficient money management is one of the most important components for both individuals and students. Now, saving money is becoming less significant for students than managing money and growing.

Money management is crucial for students since they often experience an income-expense mismatch. This is why it has become important for them to master money management skills. However, there are numerous online courses available that can help them manage money and personal finances in a far better way. These courses are easily accessible and are designed to be easy enough for beginners as well. Online money management courses can provide you with the information and skills you need to reach your objectives, whether they be to pay off debt, construct a budget, or make better financial decisions.

Today, in this blog post we are going to talk about online money management courses that can help you understand the basics behind money management and open the door for better career opportunities. There are also resources available online where you can get assistance with your queries like “Where should I pay someone to do my online course for me?” as well So, let’s dive into the world of money management and know what online courses are available to take to better manage your finances.

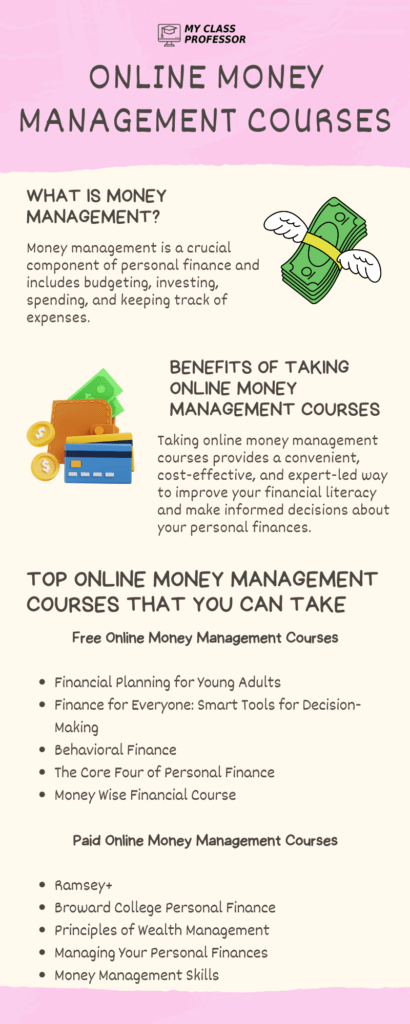

What is Money Management?

Money management, often known as investment management, is the act of keeping track of expenditures, investing, budgeting, banking, and determining tax obligations. The goal of money management is to cut down on spending made by people, businesses, and organizations on things that don’t significantly improve their level of life, long-term portfolios, or assets.

Following are a few examples of how money management might appear:

- Creating a budget for oneself

- Establishing a reserve fund

- Settling debt

- Purchasing a mutual fund

- Retirement planning

- Making educational savings

Students who are weak in managing their finances should learn about money management by taking an online course. These courses are made to help students become ready to balance and manage their finances for future purposes.

Read Here: Everything You Need To Know About Online MBA Programs

Benefits of Taking Online Money Management Courses

An online course on money management teaches students crucial life skills. It will make you aware of the financial trouble that can be avoided by being aware of the fundamental basics. This includes budgeting, investing, and managing debt. You will discover numerous crucial lessons, such as how to increase your credit score and save money for the future or education. Furthermore, it may bring about not just financial success but also stability.

Basically, figuring out how to boost esteem from your pay is critical learning for your monetary prosperity. In addition, as the most well-known and successful investor in the world, Warren Buffett, put it: “You will work till the day you die if you can’t figure out a method to earn money while you sleep”. However, you may accomplish this for yourself by signing up for an online course on money management.

Money management courses are closely related to math as well. It involves mathematics concepts and calculations. This will help you in improving your mathematical abilities as well. However, we understand that tackling mathematics calculations related to money management in an online class is not a cup of tea for many students. They become anxious and started looking for someone by searching “Who will take my online math class for me?” In this situation, students can seek out online resources for assistance with their online math classes.

Top Online Money Management Courses That You Can Take

You may graduate from college with a better financial future if you have a solid understanding of money and budgeting. Additionally, you can discover various reasonable and free money management courses online, so you don’t have to spend a lot of money on classes to advance your financial literacy.

Below we have listed some top free and paid online money management courses that you can pursue:

Free Online Money Management Courses

Financial Planning for Young Adults

This entry-level course teaches young individuals basic financial planning concepts. It was developed by the Certified Financial Planner Board of Standards and the University of Illinois at Urbana-Champaign. It takes roughly 20 hours to finish this self-paced setup from Coursera, which has eight modules.

Students will learn about the topics including setting financial goals, budgeting, and saving techniques through lecture-style lectures and brief video vignettes. However, you need to pay a price to get a certificate even when the course is free. Additionally, financial assistance is offered to needy students.

Finance for Everyone: Smart Tools for Decision-Making

This well-regarded financial course is actually intended for everyone, whether you are trying to learn about investing, debating whether to go to college or thinking about saving money. This online course is provided where students will learn about stocks and bonds, the principles of financial literacy, and basic and advanced applications. This is a seven-module course.

You can view the course materials for free as the class is open to auditing. However, you must pay the $49 upgrade fee to take the exams and quizzes and to get a certificate of completion.

Behavioral Finance

This course is offered by Duke University that focuses on the motivations underlying our financial decisions and offers suggestions for future decision-makers using a combination of lecture-style videos and texts. This five-hour course is given totally online on Coursera. Students enrolled in this course will learn about the psychological factors that contribute to bad financial, spending, or budgeting decisions.

There is a quiz at the end of each of the three modules. Students may access all of the course materials through the free course. However, it does not come with a certificate of completion. You will have to pay the $49 extra upgrade price for it.

The Core Four of Personal Finance

These classes from BrainyMoney walk you through the four fundamentals of personal finance: earning more than you spend, paying off all debt, cutting expenses, and investing regularly. This beginning course covers a range of financial topics, including managing debt, understanding investing, and the fundamentals of recessions, over the course of 24 sessions.

This course is free to try out and comes with over five hours of instructional videos, downloadable materials, and quick readings for a brief trial time. However, a certificate is available to course participants who pay a fee.

Money Wise Financial Course

This course is offered by Brigham Young University which mainly emphasizes faith-based decision-making. It is open to and understandable by anybody interested in learning about personal finance. In this course, you will learn about financial concepts, budgeting, saving, investing, taxes, and avoiding credit and debt.

However, this course does not contain a completion certificate but offers a ton of downloads. Students get access to a 327-page handbook that includes interactive articles and content, three interactive packets, and one outline. Additionally, a PowerPoint presentation is also available for download for every chapter.

Also Read: Essential Digital Literacy Skills for UK and US Online Learners

Paid Online Money Management Courses

Ramsey+

Ramsey+ is more of a platform instead of just one course. It gives students access to budgeting tools, online courses, and professional assistance to assist them in managing their finances, getting rid of debt, and accumulating wealth. Ramsey+ is home to a sizable community of Dave Ramsey’s students who are there to study and provide support to other students.

This is an extraordinarily extensive offering for just $129.99 for a full year of membership. However, you can still choose a three-month plan for $59.99 or a six-month plan for $99.99 if the price is too high for your budget.

Broward College Personal Finance

The goal of this online course is to provide you with the information and abilities required for successful, long-term personal financial planning. This extensive course covers a wide range of topics, including how to create clear financial objectives, make wise investment decisions, and raise credit scores.

Additionally, the course will also cover topics including recordkeeping standards, basic home bookkeeping, and more. By the end of the course, you will have a finished retirement savings plan, have the knowledge necessary to choose investments wisely, and know how to properly manage your own money for a more stable financial future.

Principles of Wealth Management

Nearly every student can benefit from the concepts presented in this course. You will be able to invest your money more wisely if you have more knowledge about market collapses, diversification, risk, and return.

This is the most specialized course. Thus, to benefit from it to the fullest, you must be a student pursuing a bachelor’s or master’s degree or a working professional in the wealth management sector.

Managing Your Personal Finances

This online course is created for individuals who are new to personal finance and want to learn the basics. In this course, you can anticipate learning about how to work for a living, save money, invest that money to expand it and modify your assets over time.

There are four modules, 22 videos, and four exams in the course. Additionally, students will receive a completion certificate that may be shared immediately on their LinkedIn page. However, this course might contain some sort of statistics. However, if you find it difficult to deal with statistics, you can hire someone to take my online stats class for me as well.

Money Management Skills

The lectures in this course will go beyond the recommendations of a conventional course and explore the developing field of financial decision-making. With the help of this course, you will discover how to override your brain’s training and steer clear of letting your feelings lead you in the wrong direction financially.

These 12 hands-on lectures from financial expert and Texas Tech University professor Michael Finke will increase your comfort level with money management. This course is intended for students who wish to make wise financial decisions without being fixated on the constant swings in the market.

Conclusion

Online money management courses can assist you in improving your investment, savings, or financial management selections regardless of your financial circumstances. Moreover, you will be able to get the help you need and get a head start on your financial objectives by devoting time to your financial education. Therefore, don’t delay and start right away!

FAQs

Why do financial stability and success require effective money management?

Money management is crucial for success and stability in the financial world. It enables people to allocate resources properly, make budgets, and exercise spending restraint. Furthermore, an individual can attain their financial goals and ensure their future by saving money and investing their money wisely.

How much do online courses in money management cost?

The cost of online money management courses might vary significantly depending on the provider, course content, and length. While some courses are free or inexpensive. Those given by prestigious institutions may cost anywhere from $50 to $300 or more.